Interpretation

What problem this simulation solves

Many investors trim positions during strength and plan to buy back later.

The core question is not just:

“Did I make more money?”

but also:

“Did trimming improve or hurt my ability to rebuild the position?”

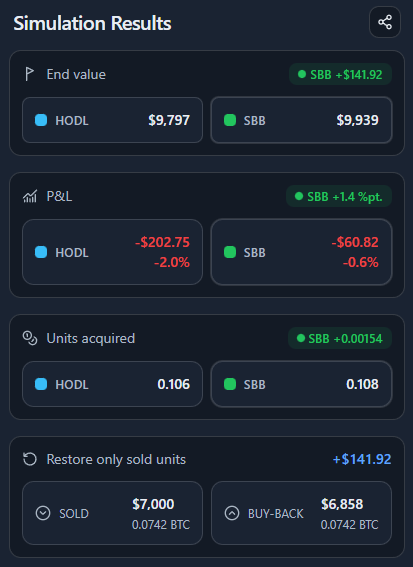

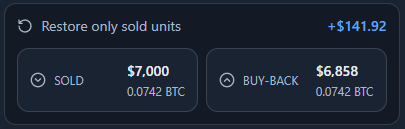

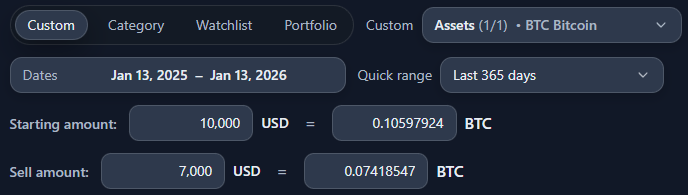

Sell & Buy Back makes this explicit by comparing a do-nothing Hold against a partial sell + later rebuy, measured both in fiat and in crypto units.

What you’re looking at

You are comparing two paths over the same time period:

- Hold

Keep the entire position unchanged.