Volatility drag explains why two price paths with the same average return can produce very different outcomes.

It is the reason compounding is sensitive to volatility — and why “average returns” often overstate real-world results in volatile markets like crypto.

What volatility drag represents

Volatility drag is the loss in compounded growth caused by variability in returns.

It arises because:

- gains and losses compound multiplicatively

- losses require larger gains to recover

- variability reduces geometric growth

Even when average returns are identical, higher volatility produces lower final value.

A simple example

Consider two assets with the same average return:

Asset A (low volatility)

+5%, +5%, +5%, +5%

Asset B (high volatility)

+20%, −10%, +20%, −10%

Both average +5%.

But Asset B ends lower.

The difference is volatility drag.

Arithmetic vs geometric returns

Volatility drag reflects the gap between:

- arithmetic returns (simple averages)

- geometric returns (compounded outcomes)

As volatility increases:

- arithmetic averages stay similar

- geometric outcomes deteriorate

This gap widens rapidly in volatile markets.

Why volatility drag matters in crypto

Crypto assets exhibit:

- extreme volatility

- clustered large moves

- deep drawdowns

As a result:

- path matters more than averages

- missing a few extreme days changes outcomes

- volatility dominates compounding behavior

Volatility drag is structural, not accidental.

Volatility drag vs drawdown

Volatility drag and drawdown are related but distinct:

- Drawdown measures how deep losses go

- Volatility drag measures how variability erodes growth

An asset can recover from drawdowns but still suffer long-term drag.

Volatility drag in strategy comparison

Volatility drag explains why:

- “best days” matter disproportionately

- smoothing returns can improve outcomes

- strategies with similar averages diverge over time

Path-based comparisons reveal drag that averages hide.

Why higher returns don’t fix volatility drag

High upside does not cancel volatility drag.

A +50% gain followed by −40% loss still leaves you down.

As volatility increases:

- required recovery accelerates non-linearly

- drag compounds faster than intuition suggests

Common misconceptions

“Higher volatility means higher returns”

Not necessarily.

Volatility increases dispersion, not expected value.

“Volatility drag only matters short-term”

False.

Drag compounds over long horizons and dominates outcomes.

“Averaging returns is enough”

Misleading.

Averages ignore compounding effects.

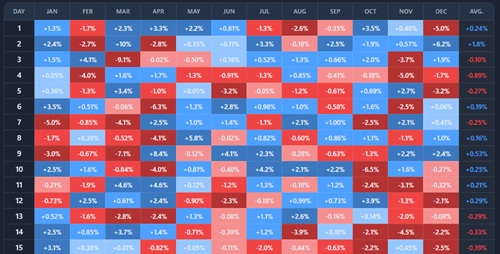

When volatility drag is most visible

Volatility drag is most visible when:

- comparing different paths

- analyzing “best vs worst days”

- studying high-beta assets

- evaluating frequent trading strategies

When volatility drag is overlooked

It is often overlooked when:

- focusing on average returns

- ignoring drawdowns

- comparing single-period outcomes

- relying on simplified backtests

Key takeaway

Volatility drag is the hidden cost of variability.

- Compounding punishes volatility

- Paths matter more than averages

- High returns don’t offset instability

- In crypto, volatility drag is unavoidable

Understanding volatility drag explains why how you get there matters more than how fast you move.