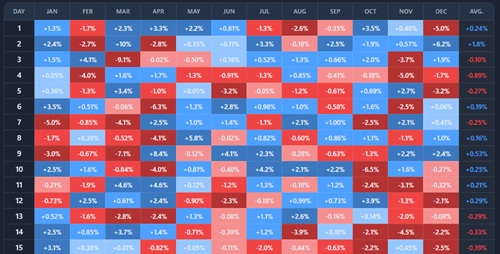

In many markets — especially crypto — a small number of days drive a large share of long-term returns.

This phenomenon is known as return concentration. It explains why timing mistakes are so costly, why missing a few days can flip outcomes, and why average returns often hide the true drivers of performance.

What return concentration represents

Return concentration describes how unevenly returns are distributed over time.

Instead of gains being spread evenly:

- most days contribute little

- a handful of extreme days dominate outcomes

- losses are often clustered as well

Performance depends on being present during a small number of critical periods.

Why returns are concentrated

Return concentration arises from structural market dynamics:

- volatility clustering

- leverage and liquidations

- reflexive price moves

- narrative-driven surges

- thin liquidity during stress

Large moves tend to occur in bursts, not gradually.

Best days vs average returns

Average returns assume smooth compounding.

Real markets are not smooth.

Two assets can have the same average return, but:

- one relies on a few extreme days

- the other compounds steadily

The first is far more fragile to timing errors.

Why missing the best days matters so much

Missing a small number of top-performing days can:

- erase years of gains

- turn profits into losses

- dramatically reduce compounding

This is because:

- large positive days carry disproportionate weight

- gains and losses are asymmetric

- recovery math is unforgiving