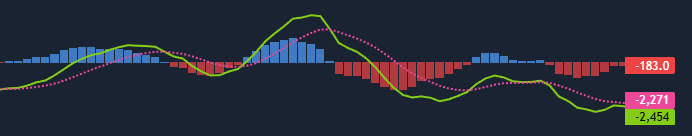

Interpretation

What problem this visualization solves

Raw price charts show what happened, but not how or why price moved the way it did.

Technical analysis tools help you:

- identify trend direction and trend changes

- gauge momentum and exhaustion

- understand volatility expansion and contraction

- put price moves into structural context

This chart brings the most commonly used TA views into a single, fast exploration workflow.

What you’re looking at

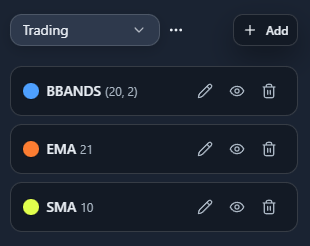

The chart shows the price evolution of a selected crypto asset over time, with optional overlays and indicators that transform price into signals.