Interpretation

What problem this visualization solves

Comparing crypto assets by price alone is misleading.

Bitcoin at $90,000 and Ethereum at $3,000 tells you nothing about which asset performed better, how much risk was taken, or when leadership changed. Percentage returns are harder to track visually across assets, especially over longer periods.

Indexed Performance Comparison removes price-level bias so relative performance can be evaluated directly.

What you’re looking at

Each selected asset is converted into an index that starts at 100 on the chosen start date.

- The vertical axis represents percentage change relative to the start

- A value above 100 means the asset is up since the start date

- A value below 100 means it is down

Because all assets share the same starting point, their performance paths can be compared directly.

How the index is constructed

For each asset:

- The price on the selected start date is set to 100

How to use

Controls and options

You can use the Indexed Performance Comparison tool to:

- Select up to three assets to compare

- Adjust the start and end dates

- Change the time window to study different market regimes

- Share the chart state for discussion or documentation

Changing the start date can significantly alter the interpretation, so it should be chosen intentionally.

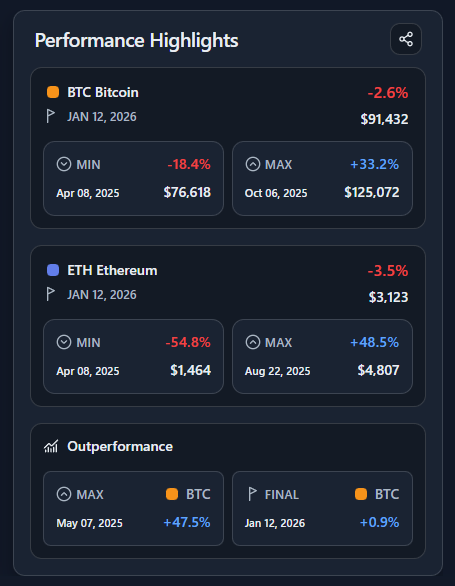

Performance Highlights panel

The Performance Highlights panel summarizes key outcomes numerically:

- Final performance

Where each asset ended relative to the starting index - Minimum and maximum

- Deepest drawdown (with date and price)

- Maximum gain achieved during the period

- Outperformance

- The largest performance spread between assets

- Which asset finished ahead at the end date

This panel answers:

“Who won, how painful was the journey, and when did it matter most?”