Markets don’t move uniformly.

Capital rotates.

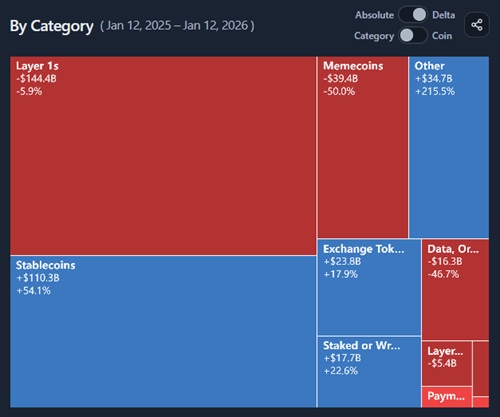

Rotation describes the process by which capital flows from one asset, sector, or theme into another over time. In crypto, rotation is one of the dominant forces shaping market structure, relative performance, and so-called “alt seasons.”

This article explains what rotation is, why it happens, and how to interpret it without turning it into a timing myth.

What rotation means

Rotation is the reallocation of capital across assets or categories.

Instead of the entire market moving together:

- some assets gain share

- others lose share

- leadership changes over time

Rotation is visible in relative performance, not just prices.

Rotation vs market direction

Rotation is orthogonal to market direction.

You can have:

- a rising market with rotation

- a falling market with rotation

- a flat market with strong internal rotation

Example:

- Total market cap is flat

- Bitcoin dominance falls

- Altcoin categories gain share

Prices alone may look quiet — structure is not.

Why rotation happens in crypto

Rotation in crypto is driven by several structural forces:

Capital size and liquidity

Large assets absorb capital first.

Smaller assets respond later with higher beta.

Risk appetite cycles

As risk appetite increases:

- capital moves from “safer” large caps

- into higher volatility segments

As risk appetite contracts:

- capital flows back to perceived safety

Narrative and sector cycles

Capital often clusters around: