Interpretation

What problem this visualization solves

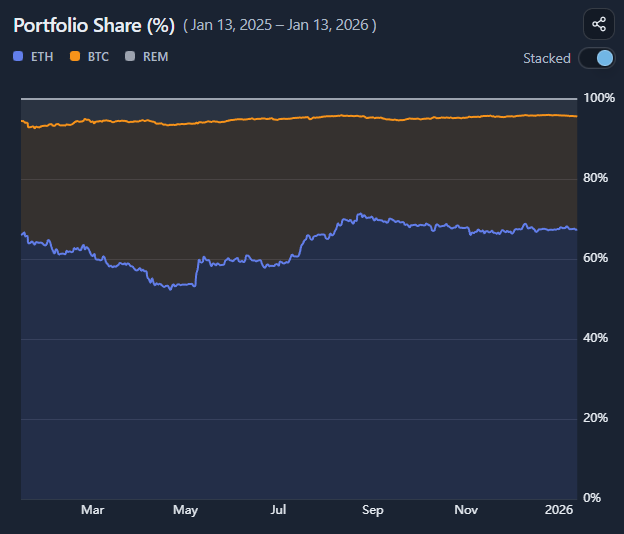

A portfolio’s total value alone does not explain how it got there.

This visualization helps answer:

- Which positions drove growth or drawdowns?

- How did allocation change over time?

- Did performance come from concentration or balance?

Portfolio Development separates absolute value change from relative position share, making portfolio dynamics explicit.

What you’re looking at

This page consists of two linked charts: