Interpretation

What problem this visualization solves

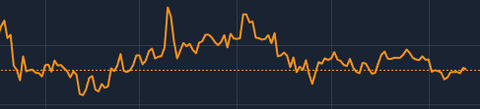

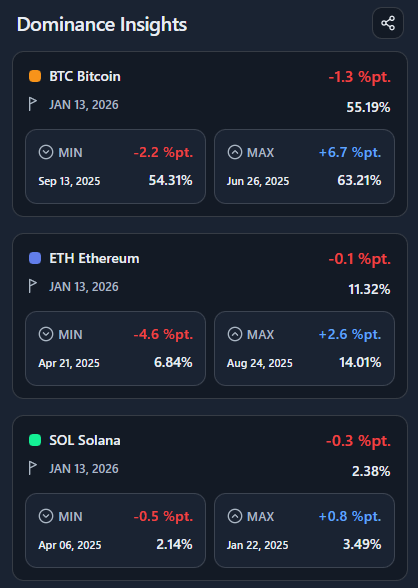

Price performance alone does not tell you whether an asset is gaining or losing relevance within the market.

Market cap dominance answers a different question:

“How much of a given market does this asset command over time?”

This visualization helps separate:

- absolute growth from relative strength

- market-wide expansion from rotation

- temporary rallies from structural leadership shifts