Interpretation

What problem this simulator solves

Investors often debate whether it’s better to:

- invest everything at once (HODL / lump sum), or

- spread investments over time (DCA)

Both approaches feel intuitive, but their outcomes depend heavily on timing, volatility, and trend direction.

This simulator makes that trade-off explicit by replaying both strategies over the same historical price path.

What you’re looking at

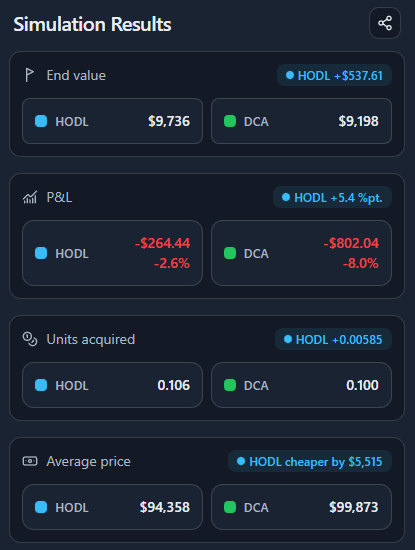

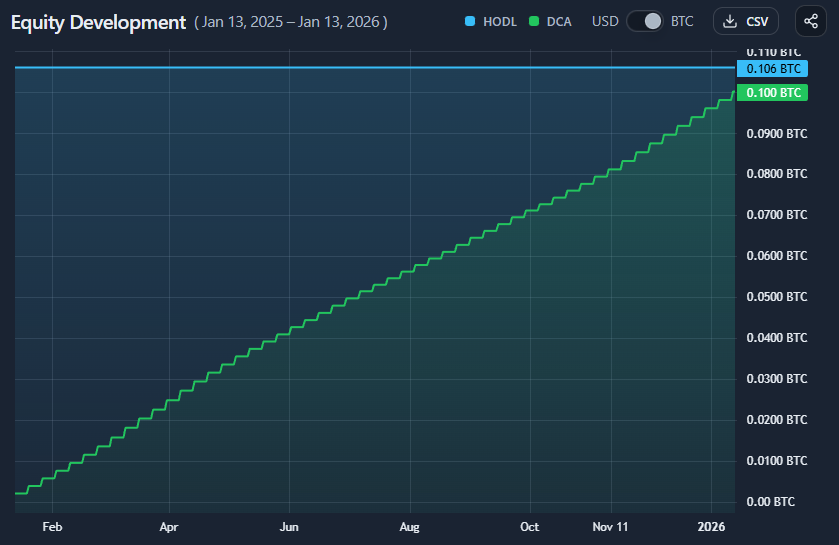

The simulator compares two investment paths for the same asset and time range:

- HODL

The full amount is invested on the first day and held throughout. - The same total amount is invested gradually in equal tranches on a fixed cadence.