Interpretation

What problem this simulation solves

Stop losses feel protective in theory, but in volatile markets they often raise a painful question:

“Would I have been stopped out anyway?”

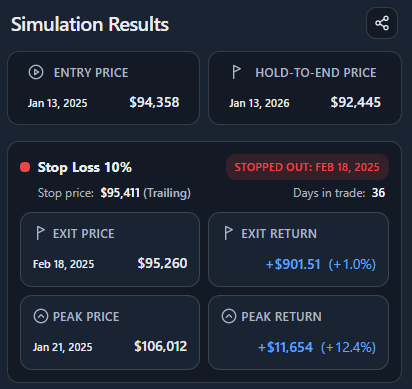

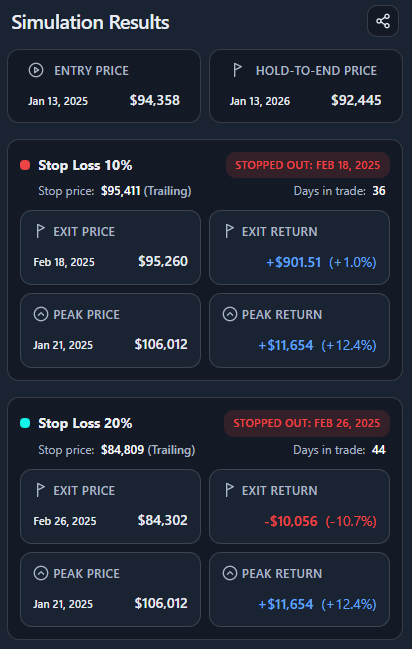

This simulator answers that question explicitly and visually, using real price paths instead of intuition. It shows if, when, and at what price a fixed or trailing stop would have exited your position.

What you’re looking at

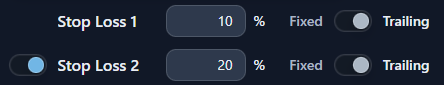

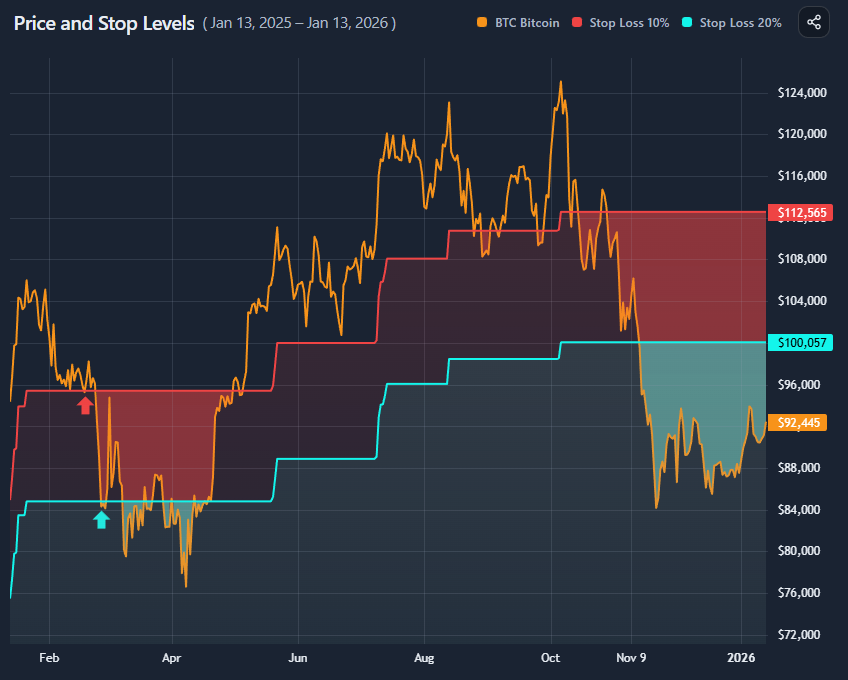

The chart overlays stop logic directly on price:

- Price line shows the asset’s actual price path

- Stop level line(s) show where your stop(s) would have been