Interpretation

What problem this simulation solves

Crypto investors often ask a simple but slippery question:

“What if I had switched from one coin into another at the start?”

Price charts alone don’t answer this properly, because they ignore position size and denomination effects. A trade can look good in USD terms but still leave you with fewer units of your original asset.

Coin Flip makes this explicit by simulating a real position and comparing outcomes both in fiat and in crypto terms.

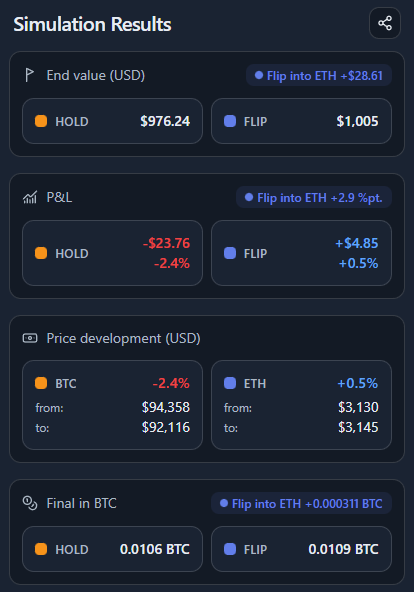

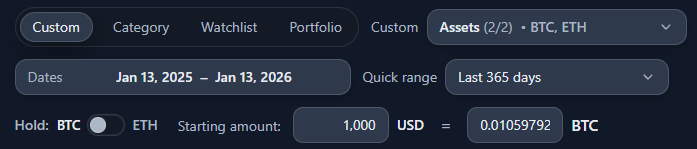

What you’re looking at

You are comparing two paths over the same time period:

- Keep the base asset (e.g. BTC) for the entire period.