Interpretation

What problem this visualization solves

Once you hold multiple assets, it becomes hard to answer simple questions:

- What is my portfolio worth right now?

- How much am I up or down relative to what I paid?

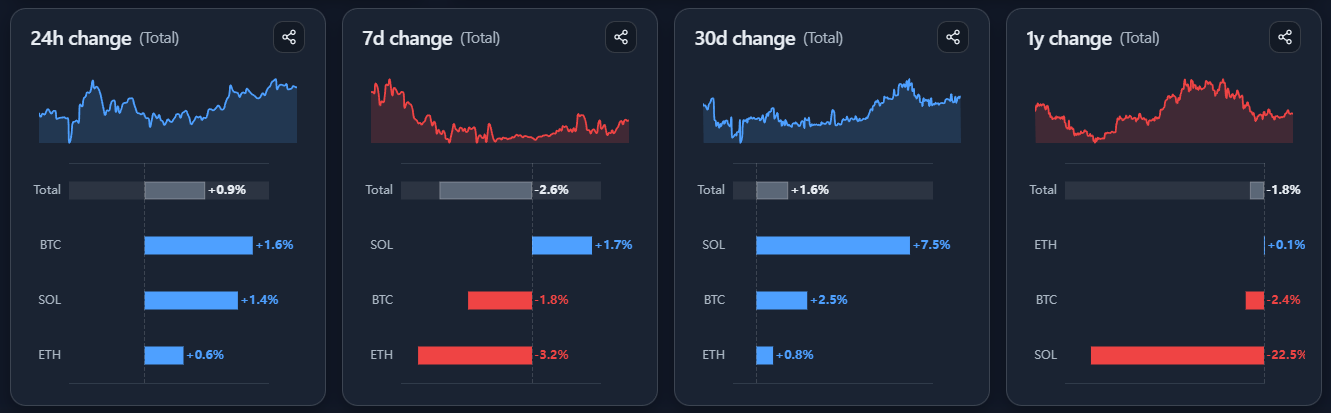

- Which assets are actually driving changes?

- How has my portfolio evolved over time?

The Portfolio Tracker answers these by pricing your holdings against current market prices and comparing them to your cost basis.

What you’re looking at

This page shows a mark-to-market view of a portfolio you defined elsewhere.

It combines:

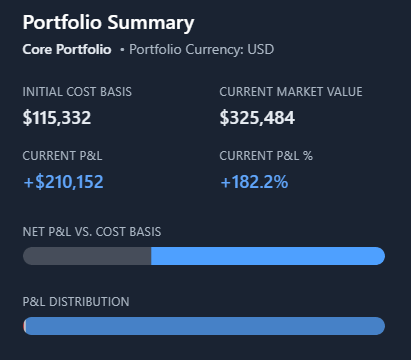

- a portfolio summary (value and P&L)

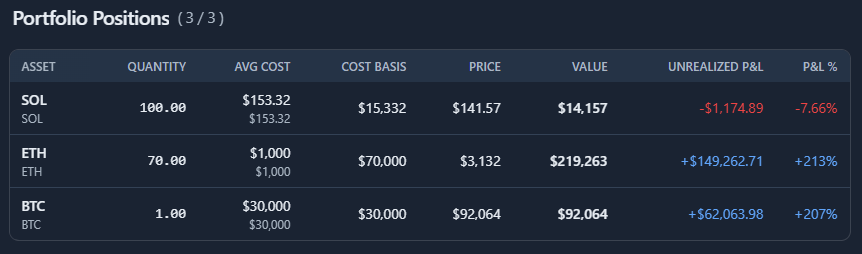

- a positions table (per-asset breakdown)

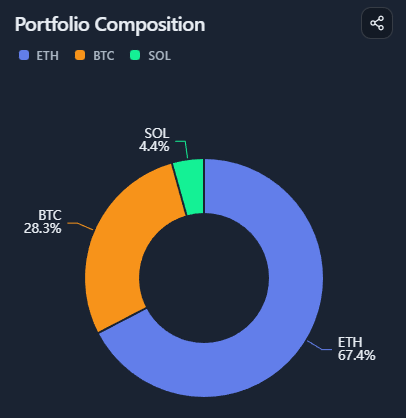

- a composition donut (allocation)

- a portfolio value time series

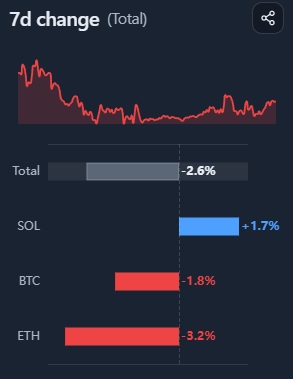

- delta summaries by asset across multiple horizons

All metrics are derived from your entered quantities and cost basis, priced with live market data.

Cost basis vs market value