Interpretation

What problem this visualization solves

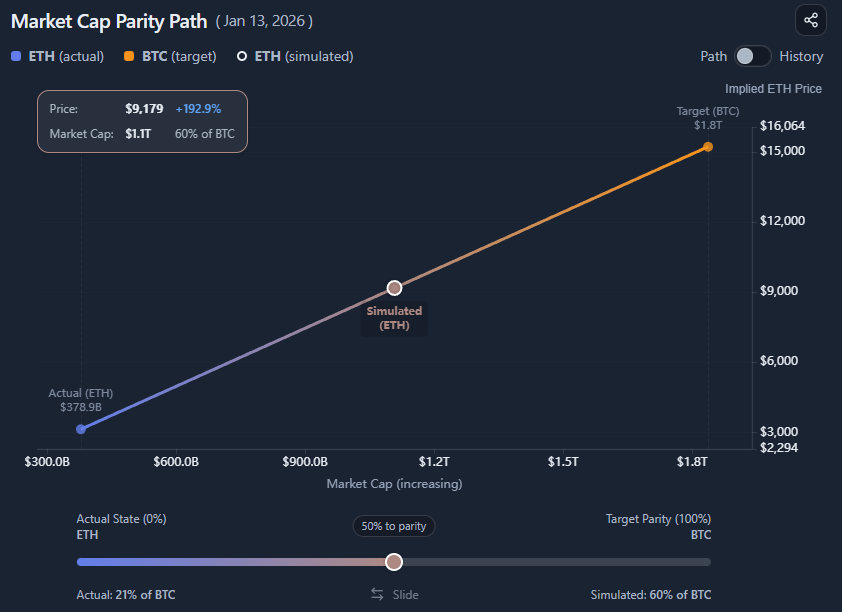

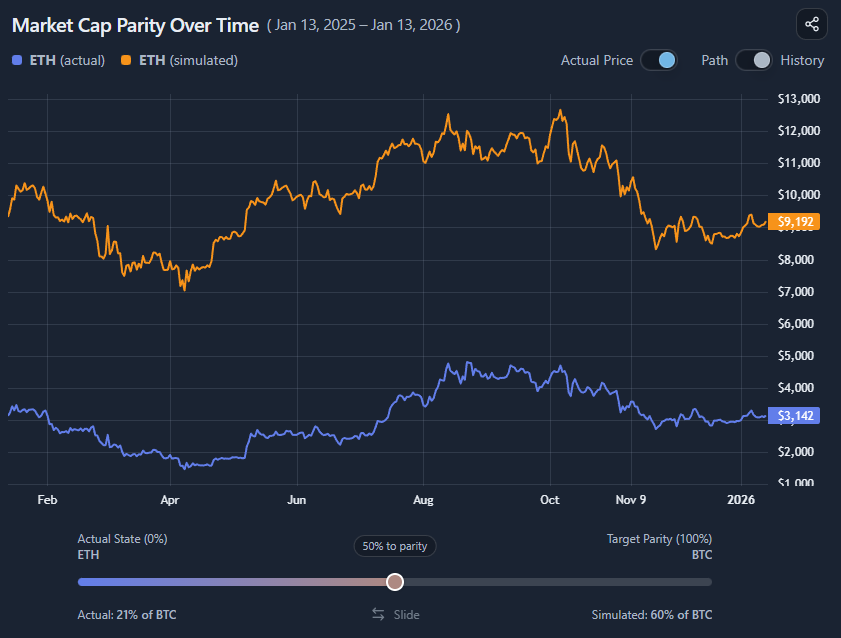

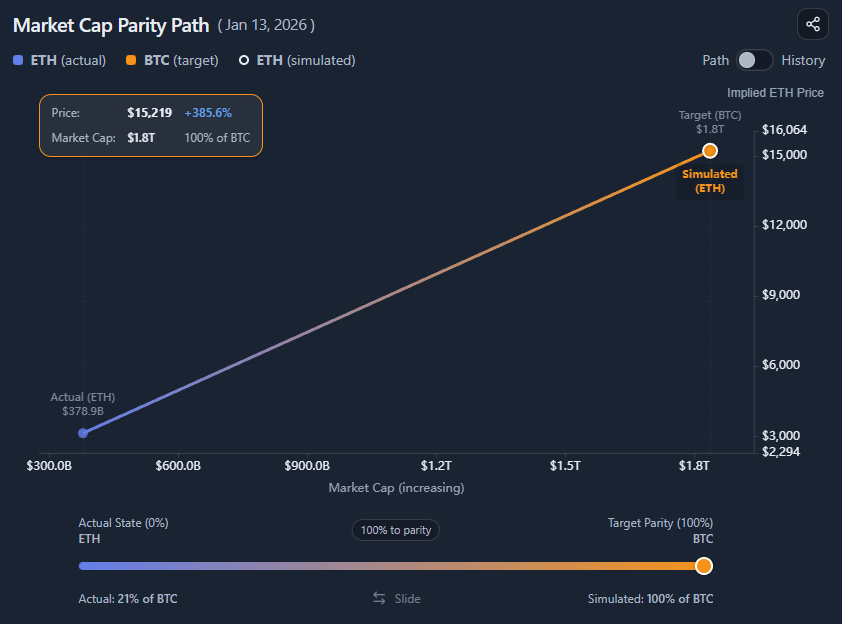

Market cap comparisons are often framed as naive statements like

“If ETH had BTC’s market cap, ETH would be $X.”

That framing hides two problems:

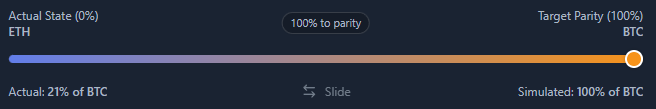

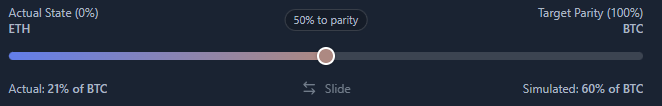

- Assets already have some share of each other’s market cap

- Market caps change over time, so forcing a fixed percentage can distort history

This simulator makes parity comparisons explicit, continuous, and time-aware.

What you’re looking at

You are looking at a market cap parity simulation between two assets:

- (the one being simulated)