Seasonality is one of the most frequently cited and least rigorously understood concepts in crypto markets.

You have likely seen claims such as “Q4 is always bullish,” “September is weak,” or “Bitcoin rallies in Up-tober.” Some of these statements are directionally true. Many are misleading. Almost all are incomplete without context.

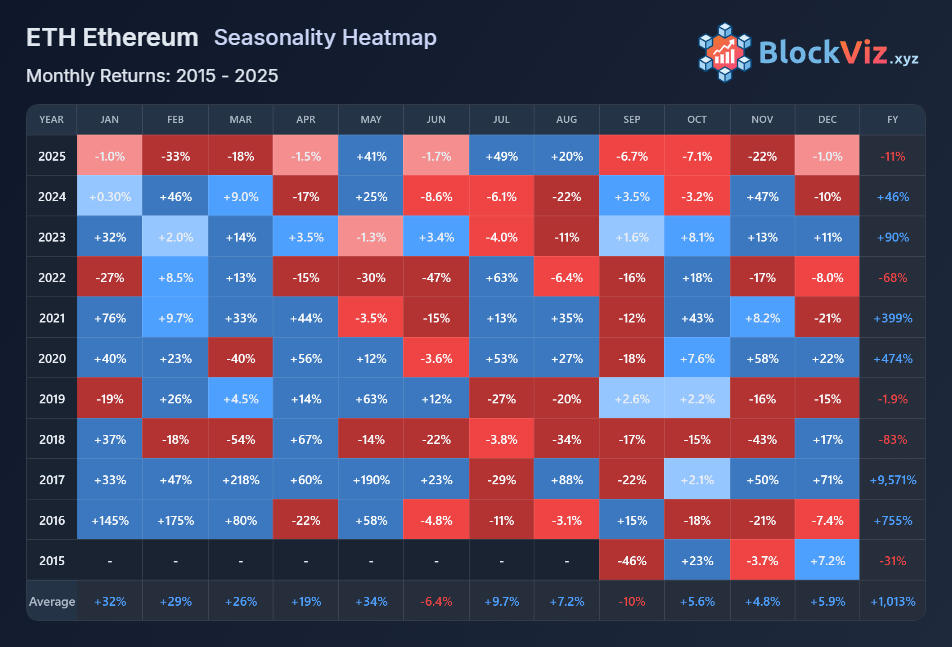

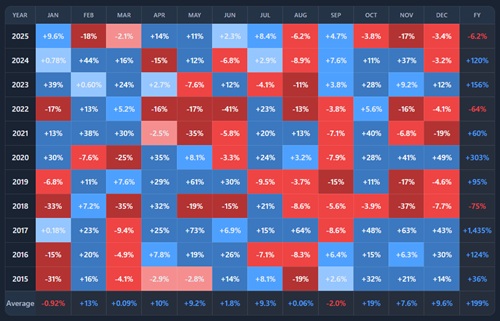

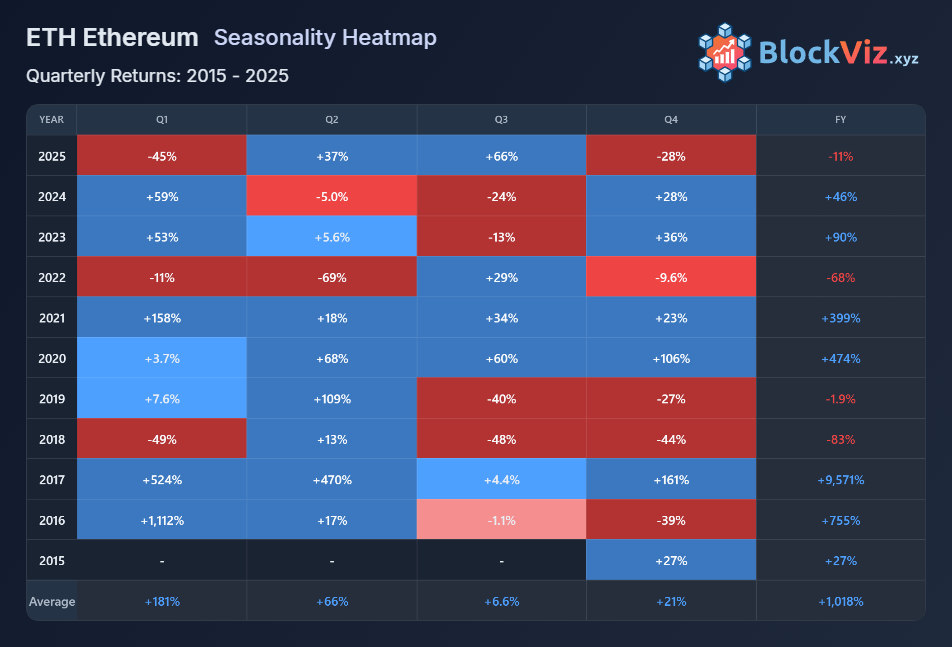

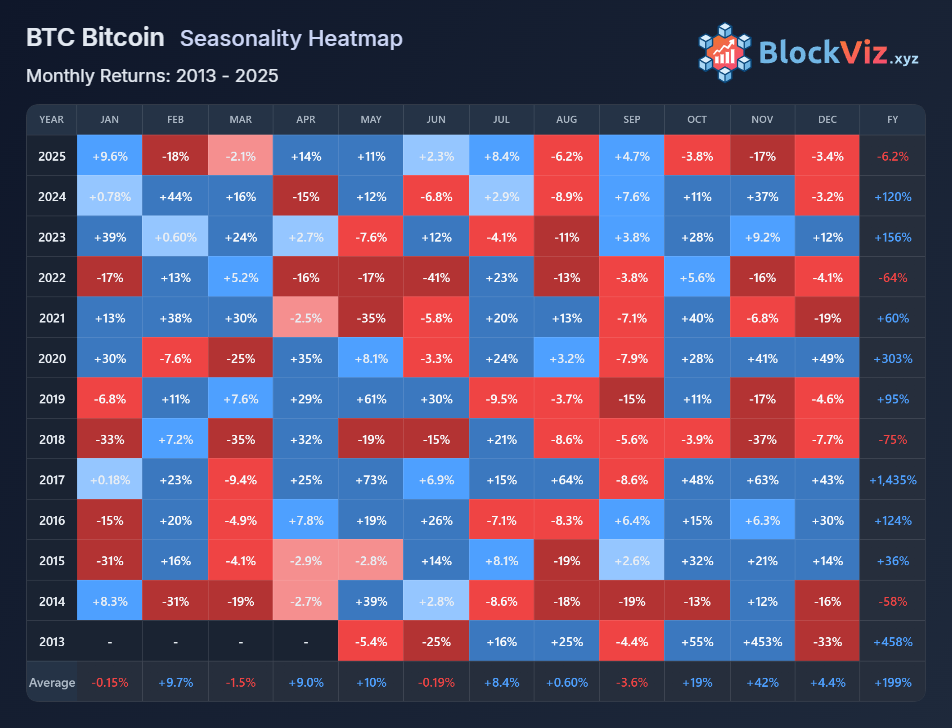

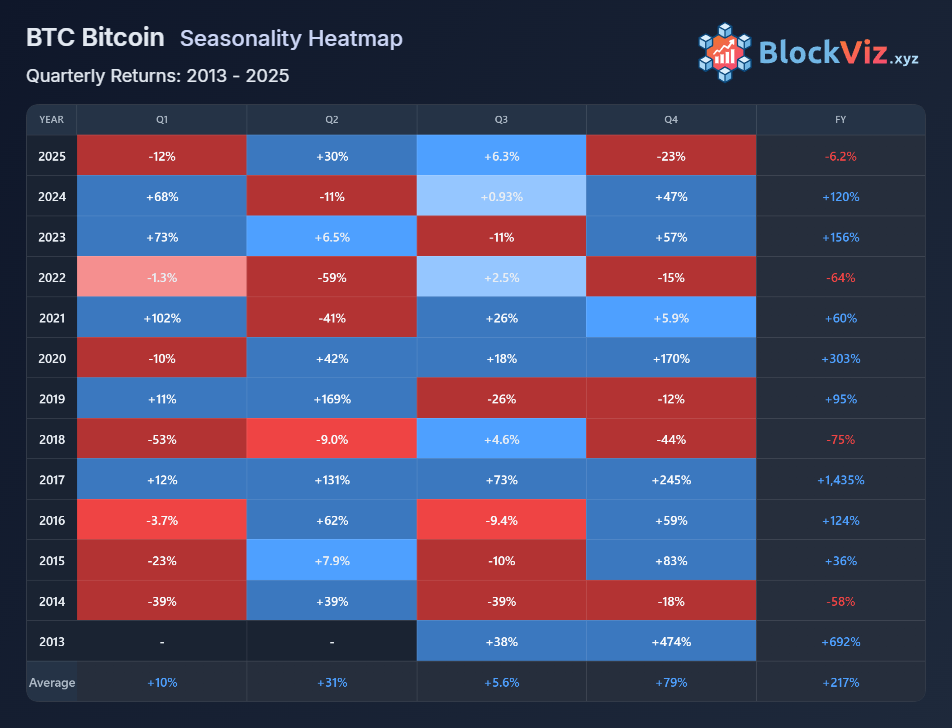

Using long-term BTC and ETH seasonality heatmaps, both monthly and quarterly, a clearer picture emerges: crypto does exhibit seasonal tendencies, but those tendencies are highly conditional on market regime and cycle position.

What the Data Actually Shows

When you aggregate returns by month or quarter across many years, patterns do appear.

For Bitcoin:

- Q4 has historically delivered the strongest average returns.

- November and December stand out across multiple bull cycles.

- Q2 tends to be more mixed, with frequent drawdowns in late-cycle or bear phases.