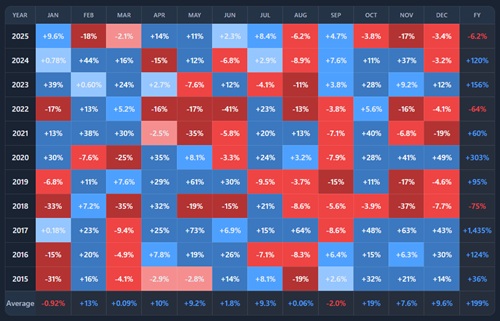

Seasonality describes recurring patterns in returns tied to the calendar—such as months, quarters, or parts of the year.

In crypto, seasonality is widely discussed and frequently misunderstood. While some calendar effects appear in historical data, they are weaker, less stable, and more regime-dependent than many narratives suggest.

This article explains what seasonality is, why it appears, and how to interpret it without turning it into a false timing rule.

What seasonality represents

Seasonality measures average performance by calendar period.

Common questions seasonality tries to answer:

- Are some months usually stronger than others?

- Do certain quarters tend to outperform?

- Is there a recurring yearly rhythm in returns?

Seasonality is descriptive, not predictive.

Why seasonality might exist

Seasonal effects can arise from structural behaviors such as:

- capital allocation cycles

- tax-related flows

- macro calendar effects

- behavioral anchoring

- market participation rhythms

In traditional markets, these forces are relatively stable.

In crypto, they are far less so.

Bitcoin seasonality vs altcoin seasonality

Bitcoin seasonality is often more visible because:

- Bitcoin has longer history

- liquidity is deeper

- participation is broader

Altcoin seasonality:

- is shorter-lived

- varies strongly by cycle

- often disappears when regimes change

Seasonality does not generalize well across assets.

Seasonality vs regime dependence

Seasonality only exists within a regime.

A bullish macro environment can make:

- many months look “strong”

A bearish environment can make: